Get Tax Adjustment Assignment Help by Experts in Australia

Understanding the concept of tax adjustment and financial concepts associated with it is a strenuous task. If you are writing your tax adjustment assignment you might need assistance from experienced professionals who will impart knowledge and how you can write an excellent tax adjustment assignment. Tax adjustment assignment help is provided by experts of Sample Assignment in Australia.

A student pursuing graduation, under graduation, and degree programs can Take assistance from academic writers which would help them score an HD grade. You might not be aware of citation and referencing styles used in Australian Universities if you are a foreign student. It is mandatory to learn new techniques to excel in your class.

What Are Taxes And Tax Adjustments?

Tax is a compulsory charge that is imposed on taxpayers by the government. Tax is collected to finance government spending and public expenditures and is paid by legal entities or individuals. If a person or a company is unable to pay tax or resist toupee a tax then it is punishable under law. There are two types of taxes: direct taxes and indirect taxes which are paid by the citizens of a country.

Tax adjustment is the transaction that takes place to adjust tax receivable and tax payables. The liability of paying tax is adjusted by the tax which is to be returned and refunded by the government. Finance Assignment Help is provided by professionals on several topics of accounting activities related to business concerns.

Types of Taxes That Are Paid By Taxpayers

Income Tax:

Income earned by individuals and business concerns is taxed. Income tax is charged on the net profit of the business or the net gain ascertained at the end of the accounting period. How income taxes are computed tax laws and principles of the particular jurisdiction. The incidence of tax varies between progressive or regressive systems. The rate of tax charged and individuals and companies may remain constant or vary based on the level of income earned by them. It is generally collected at the end of each accounting period and incorporates tax correction. Either the government receives payment from taxpayers who have deposited fewer amounts than the actual task or refunds tax to the company or individual who has overpaid the taxes.

Property taxes:

Property tax is the tax that is levied on the value of the property that the owner possesses. The owner is required to make a payment to the government under whose jurisdiction the property is situated. Property can be classified as Land, movable things made by men such as buildings, and personal properties which are also known as movable things. These taxes are charged on a recurrent basis

Goods and services tax:

The sale and purchase procedures conducted by sole proprietors or companies are eligible for a tax deduction when sales proceeds take place. Organizations collect tax from customers and are obligated to pay taxes for goods and services produced by them to the government. Adjustments take place for the same on a monthly, quarterly, or yearly basis.

Taxes such as progressive, progressive, consumption, license fees, tariffs, excise duties, sales tax, and many more are also paid by citizens of the country under the laws stated by the government. There are various classification and categorization of taxpayers. In an economy, either identical rates are charged from individuals or different rates under the taxation system are set for individuals.

Understanding the concept of taxes and its adjustment has become mandatory for everyone these days. Under, Tax Adjustment homework help you to understand the varied concepts of taxes by professional experts who have been practising and have in-depth knowledge on this subject domain for more than eight years. Business Finance Assignment Help provided by experts will train you in writing excellent taxation and Finance assignments.

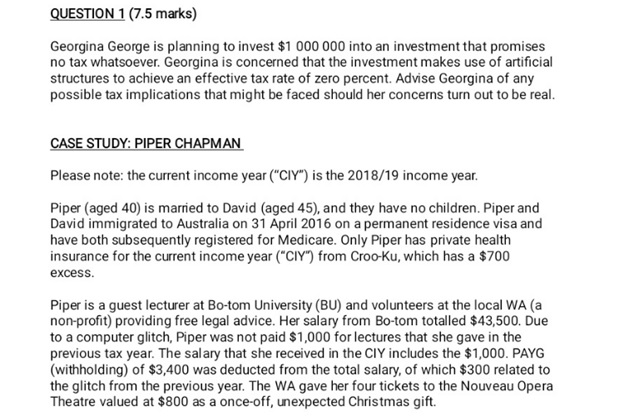

Questions Posted By Students

Experts provide solutions for case studies on tax and essays on tax policies. You can get solutions for tax ramifications and analysis for transactions that have been recorded in the organization. Legal case study solutions based on taxation and Income Tax consequences are also called by academic writers. Questions on how double taxation occurs are also asked by students. The following are the questions posted under help with Tax Adjustment Assignment help by students.

Solutions Provided By Tax Adjustment Assignment Expert to Australian Students

Finance experts provide custom writing solutions to University students at such reasonable prices. If you are an accounting student who is looking for someone to do my tax adjustment assignment for me then you have landed on the right page. You can find appropriate resources and differences from free samples that have been uploaded on several topics by assignment experts on the Sample Assignment website.

Sample Assignment is not an essay mill. Solutions are designed uniquely for individual students after you place an order for the same. Before placing an order for tax adjustment assignment help services have a look at solutions provided by academic writers.

What Benefits Will You Receive From Academic Writers Of Sample Assignment?

Every finance student aims at building a successful career, and doing so becomes easy when you have a helping hand with you. Financial services assignment help provided by experts will help you in understanding analytical as well as conceptual knowledge in subdomains of finance. With the help of academic writers, you can invest your time in studying for exams instead of being stuck with your tax adjustment assignment. Academy professionals will grant you with value-added benefits which are mentioned below.

- 100% Plagiarism free content is provided by content writers along with referencing and citation style mentioned in your assessment guidelines.

- You will receive a Turnitin report by academic writers stating the authenticity of solutions written by them.

- Resources for taxation and other finance assignments can be obtained by professionals.

- Experts engage in interaction with students to solve their queries related to the subject domains.

- Before the tax advertisement assignment is delivered to you, it undergoes a quality check by language experts, the professional, research team, and academic writers to avoid errors.

- Tax Adjustment Assignment helper assists 24/7 to ensure prompt delivery of solutions to students.

- Public finance and taxation assignment help can be obtained at a very reasonable price, and exciting discounts are offered by experts from time to time to Australian students.

Tax adjustment assignment help is your best solution to excel in your class and score HD grades in your assessments. You can also acquire free samples on other subject domains such as nursing, accounting, commerce, economics, management, legal policies, and many more. Hurry up! Writing finance and taxation assignments has been made easy by Sample Assignment.

Clients Speaks

Order Now @ Upto 50% Off

Get

Flat 50% Off

on your Assignment Now!