Get LAW3131 Revenue Law and Practice Assessment Answer via Online Tutoring

Do you realize that the current tax-exempt edge for occupant individuals in Australia is around $18,200, and the greatest minor rate for people is 45%? Most Australians are accountable to pay the Medicare levy, which is usually 2% of taxable income. If you desire to know more about Australian Taxation laws and facts, LAW3131 is the course for you!

The University of Southern Queensland offers LAW3131 Revenue Law and Practice. This course provides students with an opportunity to learn about advanced taxation law topics. LAW3130 is a prerequisite for LAW3131. By studying both the courses, a student satisfies the requirements of a course in taxation law’, which is essential for getting admission to the Tax Practitioners Board of Australia.

Sample Assignment is one of Australia’s trusted online academic guidance companies, which provides LAW3131 Revenue Law and Practice assessment answer via online tutoring with guaranteed grades and one-on-one live sessions with the subject matter experts.

What are the Learning Outcomes of LAW3131?

The course offered by the University of Southern Queensland teaches you to:

- Employ the legal principles of taxation of companies, trusts, superannuation funds, partnerships, stamp duty, special taxpayers, primary production, superannuation, international taxes and fringe benefits tax. It also equips you to explain the disadvantages and advantages of various entities;

- Understand and use professional and academic literacy skills including statutory interpretation, written communication and legal research.

- Apply and articulate comparative and international viewpoints of taxation to international transactions;

- Scrutinize taw law scenarios by applying appropriate laws and advising adhering to the problem along with using critical thinking and problem-solving skills;

- Perform enquiry and ethical research by unravelling the boundaries of the effects of Part IVA and legitimate tax planning;

- Describe the professional and ethical responsibilities of tax agents and their duties as stated under the Tax Agents Services Regulations 2009 (TASR) and the Tax Agents Services Act 2009 (TASA).

Get a LAW3131 Revenue Law and Practice assignment sample online written under the guidance of the experts. Assignments need to fulfil the requirements set by your professor and an expert can guide you to achieve that.

How old is the Australian Taxation Law?

Australia’s federal taxes are as old as the Federation. Customs and excises were given over to the federal government by the colonies-turned-States in 1901, while a federal estate tax, land tax and the first income tax were enacted in quick succession between 1910 and 1915. Other taxes, including sales tax, payroll tax, Fringe Benefits Tax (“FBT”), Petroleum Resource Rent Tax (“PRRT”) and the Goods and Services Tax (“GST”) were enacted during the 20th century (Davies & Stewart, 2021).

Source: Davies, R., & Stewart, M. (2021). The Gatekeeper Court: For the Revenue or for the Taxpayer?. Retrieved 26 November 2021, from http://dx.doi.org/10.2139/ssrn.3414811.

What are the Rules and Principles of Australian Tax Law?

To improve the basic and reliable signposts of improving Australian tax administration, some basic principles are widely used such as certainty, simplicity and neutrality, equity, efficiency, etc. most of the time students use these criteria in various law reform reports. You can avail LAW3131 Revenue Law and Practice academic assistance to get a better understanding of the rules and principles of Australian tax law.

The basic principles of equity, efficiency, certainty, simplicity, and neutrality are considered to provide reliable and basic signposts for improving tax administration. Students see these criteria utilised in various law reform reports as measures of the effectiveness of a particular tax measure.

- EquityThe first principle is equity; it involves the distribution of tax across the entire citizens equally. Mainly it is regarded that this principle covers two fundamental elements, these are vertical equity and horizontal equity. Vertical equity is regarded as the concept that taxpayers in various positions must pay different amounts of tax and horizontal equity states that each individual of the population who are in the same position should pay an equal amount of tax.

- EfficiencyEfficient taxes don't skew resource allocation choices across the economy, adding to a solid useful economy. There are again two components of efficiency. Administrative efficiency alludes to the way that tax ought to give to the public authority the biggest conceivable measure of cash from the citizen that isn't devoured by administration costs.Economic efficiency or neutrality necessitates that duty isn't unfair and guarantees that a citizen won't adjust his circumstance or be affected in his activities by any tax collection impact except if it is an expected effect of that tax.

- SimplicitySimplicity plays a vital role in the tax design and administration, it helps to decrease the level of compliance and uncertainty cost of the taxpayers. It also denotes that the taxpayers must know the importance of their obligations.

- CertaintyCertainty defines that the taxpayers should have an idea on a prior basis that they have a tax liability therefore they can make provision for that and make plans subject to such provisions.

- NeutralityNeutrality is the place where the effect of taxes ought not to impact the city's decisions by falsely contorting or changing the expenses of alternative goods, various methods of investment, or various exercises.

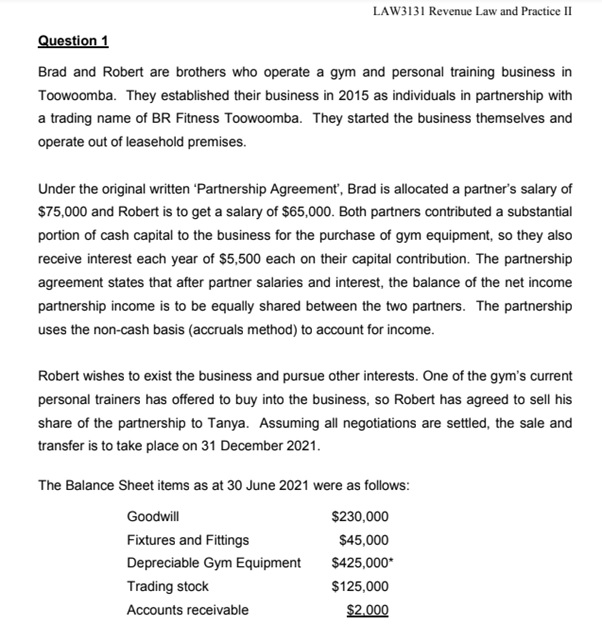

Sample Question File

Here, we have attached a LAW3131 Revenue Law and Practice assignment sample online file for your reference. It gives you an insight into the kinds of questions our experts help with.

Why Choose us to Get the Best LAW3131 Revenue Law and Practice Assessment Answer?

Sample Assignment is a leading brand for online tutoring services in Australia. We are a hub of more than 5500+ Subject Matter Experts with in-depth knowledge of academic research reports with pristine referencing styles. We promote achieving excellence via self-academic help and to support the same, we provide guidance and have a digital library of model papers and sample assignments. Get help from LAW3131 Revenue Law and Practice tutors at Sample Assignment and get other benefits like:

1:1 assistance - Our experts provide one on one assistance to students across the globe. Once you register with us, we provide you with a suitable time to connect with your subject matter expert. The expert will answer all your queries and guide you through the assignment writing process.

24x7 availability - Our experts are available 24x7 to help you. Be it a query or an assignment task with a short deadline, our experts will guide you through it at any hour. We provide assignment help online at any time of the day.

0% Plagiarism - The subject matter experts guide you to begin an assignment from scratch to help you write an assignment that is free of plagiarism.

All subject guidance - We have over 5500+ experts who have expertise in different areas to cover all the subjects taught around the world.

Live updates - Receive live session-related updates on your email and Whatsapp to not miss a session. Simply log in to our student portal and turn on the notifications as desired by you.

Frequently Asked Questions

Clients Speaks

Order Now @ Upto 50% Off

Get

Flat 50% Off

on your Assignment Now!