Get Corporate Valuation Assignment Help By Professional Experts Here

Applying aspects of finance theory to the problems of corporate valuation and other financial assets is central to the coursework of corporate evaluation. It entails synthesising concepts such as security valuation, optimal capital structures, cost of capital, present value, among other accounting concepts. Valuation exercises are complex tasks as business evaluation is subjective; Juggling intangible assets, ESOP ownership, and company life cycle makes the valuation exercise tricky, leaving students to search for Corporate Valuation assignment Help.

You can now bid farewell to the ambivalence while selecting the correct method and technique for valuation or worrying about the intangible assets and relevant information affecting the valuation. Our subject matter experts hold solid accountancy experience which helps them offer accurate help to students. These solutions are reliable and assure high distinction grades. Ease your academic life today by relying on our experts to provide the best assignment help on corporate valuation.

Methods of Corporate Valuation

The value of a company can be evaluated with the following methods. These methods are an integral part of Corporate Valuation assignment solutions. We have simplified the following for your reference -

- Market Capitalization- One of the easiest ways to obtain the valuation of a business is by calculating the product of the share price and the total share outstanding of the company.

- Times Revenue Method - The revenue generated over some time, applied to the economic environment and industry-dependent multiplier gives the corporate valuation. For instance, a tech company might be valued at a 3x revenue whereas a service company might be valued at 1.5x revenue.

- Discounted cash flow method - The adjustment of the projected cash flow to the current market value of the company while taking the inflation into account gives a precise value of the business.

- Book value - The value of shareholders' equity as on the balance sheet statement. It is obtained by deducting total liabilities from the total assets.

- Liquidation value - Is the cash obtained once the company’s assets are liquidated and the liabilities are paid off.

Topics Covered Under Assignment Help On Corporate Valuation

The corporate valuation unit is studied under the graduation certificate, diploma and master’s degree for commerce and economics. A student is expected to learn to gain in-depth knowledge of the following topics-

- Corporate valuation methods - Pros and cons of valuation methods, sources of data and examining cases of valuation.

- Regulatory requirements - Regulatory environment, requirement of valuation by a regulatory requirement, rules and regulations of the regulatory environment, Determine the methods prescribed or recommended by regulatory and other authorities including APES225, Australian Taxation Office, Australian Securities & Investments Commission, Australian Accounting Standards Board, International Valuation Standards Council, and Office of State Revenue.

- Valuation case studies - valuing private companies, valuing mergers and acquisitions, assessing portfolio and controlling interests, calculating control premium.

- Financial reporting and valuation - accounting standards with specific valuation guidance, valuing intangibles, representing financial reports.

- Expert reports - the requirement of expert reports and their key concepts.

- Expert witness - role and requirement of an expert witness, appointment process and duties, relevant case laws resources.

- Contemporary practices and issues - controlling interests, common errors in reports, ESG/Stranded assets/climate risk.

Our subject matter experts are well-versed with the above topics to provide a complete Corporate Valuation assignment Help.

Research on Characteristics of a Reliable Corporate Valuation

Before discussing the characteristics of a reliable corporate valuation, here is a briefly summed up process of a corporate valuation -

- The first step is to determine the reason for valuation.

- Complete information about the financial statement is paramount for the valuation.

- Recast the financials.

- Choose and apply a corporate valuation approach.

- The corporate value report entails all the pertinent reasons for the evaluation, process and justifications employed.

List of Universities Offering this course

Here are the universities such as

- UNSW Sydney - MNGT5328 Corporate Valuation Macquarie University

- Macquarie University - Applied Business Valuation AFCP860

- University of Adelaide - CORPFIN 2502 Business Valuation

- University of South Australia - Corporate Valuation and Risk Management

A good corporate valuation process entails reliable characteristics that include the following (Zwolak, 2016) -

- Compliance of valuation following the facts

- Transparent data timelines and relative simplicity.

- Enunciation of the purpose of valuation preparation

- Based on the companies’ financial data

- Not solely dependent on the assets of the company until it concerns the liquidation methods.

- Considering the income and intangible factors

- Taking into account the cash flow forecast and rise factors.

- Taking into consideration the relevant information affecting the valuation

- Objectivity and reliability.

Corporate Valuation Assignment Sample Online

Please look at the following capital budgeting decision analysis case study answered by our subject matter experts for students.

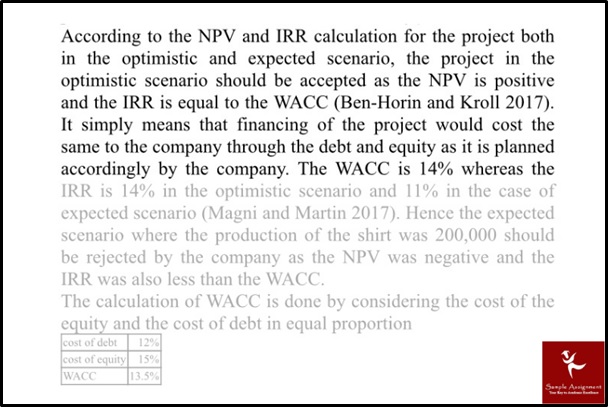

The case study help provided by our subject matter experts for the above question contains the cash forecast of the company along with the calculations of the net present value and internal rate of return. The experts concluded the assignment by analysing the WACC, which is done by considering the cost of equity and the cost of debt. The referencing style used is as per the assessment criteria of the student. Thus, offering complete Business Valuation & Finance Assignment Help to students.

Why You Should Trust Our Corporate Valuation Assignment Writing Service In Australia

You can rely on our academic writing services as we never fail to deliver assignment help on time! We offer 100% original solutions to students; these solutions are attended by PhD or postgraduate professionals with relevant industry and academic experience. You can avail of these services at an unimaginably lucrative cost and pace. Apart from complete assignment help, our experts also appear for students' online exams and quizzes on their behalf.

Frequently Asked Questions

Yes, you can avail complete assignment solution essay writing help included.

You can value a company using precedent transactions, comparable company analysis and DCF analysis.

You can use the following methods to calculate the value of a startup -

- Book method

- Cost-to-Duplicate Approach

- Discounted Cash Flow Method

- Comparable Transactions Method

- Risk Factor Summation Method

- Scorecard Valuation Method

Yes, our accountancy experts can deliver accurate and reliable solutions for corporate valuation coursework.

Clients Speaks

Order Now @ Upto 50% Off

Get

Flat 50% Off

on your Assignment Now!