HA3042 Assignment Deals with Jasmine’s Capital Gains and Losses

Every assignment comes with few purposes and HA3042 - T2 assignment assign to students for the following reasons:- Develop knowledge and practical skills of tax law aspects

- Check whether students can apply legal tax principles or not

- Best ways to analyse issues related to tax laws

- Introduction

- First answer

- Answer 2

- Conclusion

- References

Ideas To Write HA3042 - Taxation Law Assignment

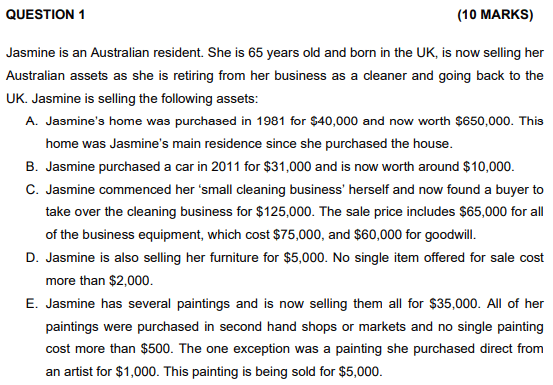

Based on the above figure, you are required to deal with Capital Gain Tax. You must answer the following questions:

Based on the above figure, you are required to deal with Capital Gain Tax. You must answer the following questions:

- What is the capital gain about the family home?

- Capital loss or gain incurred from the car

- The capital gain related to the business sale

- The capital gain after selling furniture

- The capital gain concerned with the selling of paintings

Answer 4: To answer " capital gain concerned with the selling of furniture" in case of the above-given case study, you must observe whether the selling of furniture attracts capital gain or loss or not. To know this, you should know every act concerned with capital asset gain or loss on personal assets. If you find difficulties in answering such questions, Sample Assignment is available with multiple samples for HA3042 - Taxation Law assessment.

Answer 5: We come to see that the assessee has sold and purchased different second-hand artworks. Here, you must discuss the taxability and whether artworks like jewels coins, paintings, etc. comes under the capital asset definition (Income Tax Assessment, 1997) inter alia section 118. When you will go through the given section, you will find that paintings fall under capital assets, therefore, if any gain arises then it will be taxable as per the Act. More details about Income Tax Assessment, 1997, you can consult with our law experts as they are well-versed with every taxation law Act.

Answer 4: To answer " capital gain concerned with the selling of furniture" in case of the above-given case study, you must observe whether the selling of furniture attracts capital gain or loss or not. To know this, you should know every act concerned with capital asset gain or loss on personal assets. If you find difficulties in answering such questions, Sample Assignment is available with multiple samples for HA3042 - Taxation Law assessment.

Answer 5: We come to see that the assessee has sold and purchased different second-hand artworks. Here, you must discuss the taxability and whether artworks like jewels coins, paintings, etc. comes under the capital asset definition (Income Tax Assessment, 1997) inter alia section 118. When you will go through the given section, you will find that paintings fall under capital assets, therefore, if any gain arises then it will be taxable as per the Act. More details about Income Tax Assessment, 1997, you can consult with our law experts as they are well-versed with every taxation law Act.

In the question #2 of HA3042 Taxation law Individual Assignment T2, you are asked to find and discuss the issues. For instance, you are asked to illustrate and explain the elements for the cost of a CNC machine and also find out the legal principles to be used to resolve the problem. In the end, articulate and provide the strongest argument to conclude your assignment. Finding difficulties in calculating the cost of the CNC machine to know the capital allowance or calculating the value of the asset or unable to find appropriate legislative references for your information, get in touch to Sample Assignment.

In the question #2 of HA3042 Taxation law Individual Assignment T2, you are asked to find and discuss the issues. For instance, you are asked to illustrate and explain the elements for the cost of a CNC machine and also find out the legal principles to be used to resolve the problem. In the end, articulate and provide the strongest argument to conclude your assignment. Finding difficulties in calculating the cost of the CNC machine to know the capital allowance or calculating the value of the asset or unable to find appropriate legislative references for your information, get in touch to Sample Assignment.

Contact Sample Assignment for the Best Help with HA3042 Taxation Law Individual Assignments

If you are a student at Australian Holmes University and need assistance in writing the HA3042 the Taxation Law assignment, then do contact Sample Assignment right away. We are engaged in offering multiple services that are quite helpful to deal with academic activities. These include dissertation writing services, case study assignment help, essay assignment help, and we can also provide the complete HA3042 Taxation Law Assessment Sample on request. All these services can be obtained at a low price from our teams. So, to reach Sample Assignment, students can visit our official website and send queries via live chats or email id. You can also directly dial our customer support phone number.Order Now @ Upto 50% Off

Get

Flat 50% Off

on your Assignment Now!

Loved reading this Blog? Share your valuable thoughts in the comment section.

Add comment