Enjoy Top-Notch ACCT6005 Taxation Law and Practice Assignment Help

Do you know what is the tax law in Australia? Do you know how to pay taxes in Australia? Well, Taxation in Australia is done on a progressive scale, which means that the rate of tax payable increases as taxable income increases. Non-residents, who come to Australia for work purposes, and who are treated as residents for tax purposes can also qualify for taxation as residents.

During the ACCT6005 Taxation Law and Practice course, you will get to know so many things about the tax system of the country. The course is going to give you a real picture of the taxation system and how it works. If you require ACCT6005 Taxation Law and Practice assignment help during the course, then you can contact us anytime.

The course Introduces Australian taxation legislation and practice, as well as the interrelationship between various levies. The Commonwealth and the States will each levy taxes on various entity categories. Tax administration and related information systems are also covered in this section. Students will improve their tax knowledge, application, and communication skills by participating in teacher-directed activities.

The Fringe Benefits Tax Assessment Act 1986, the Income Tax Assessment Act 1936 (ITAA 1936), the Income Tax Assessment Act 1997 (ITAA 1997), the Taxation Administration Act 1953 (TAA 1953), and the Tax Agent Services Act 2009 are all covered in this unit (TASA). If you ever feel the need for ACCT6005 Taxation Law and Practice academic assistance, then always keep in mind that our team is just one call away from you. We will be happy to serve you our assignment assistance service via online tutoring.

Learning Outcomes of the Course Explained by Our ACCT6005 Taxation Law and Practice assessment answer Providers

We always say that these types of courses give real-time experience and knowledge to the students which they can use in their day-to-day life as well. You will get the opportunity to learn a lot from this course, and it will even help you to get a fruitful career after completing the course program. Our team have added here the learning outcomes of the course; take a look at the benefits of studying this course -

- Communicating with client taxpayers with a variety of technical tax information

- Apply and debate the fundamentals of Australian income tax law and practice as they relate to individual and small company taxpayers.

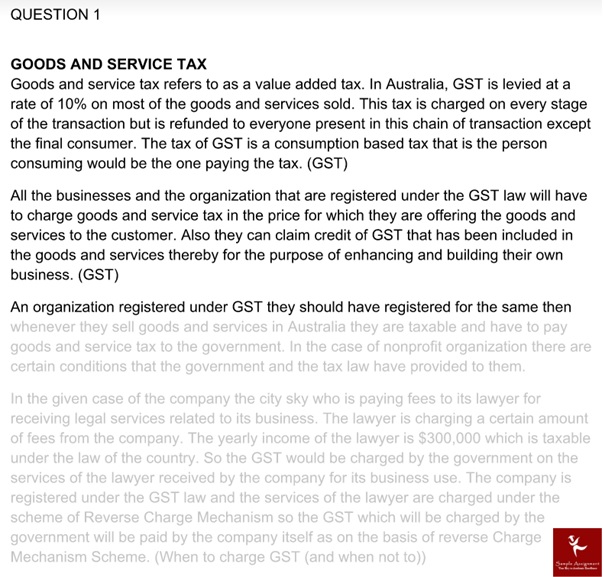

- Discuss the concepts of the GST, fringe benefits tax, wine tax, luxury car tax, and fuel tax, as well as state-based taxes such as payroll tax, stamp duty, and property tax.

- Answer particular tax difficulties and queries in the areas of income tax, fringe benefits tax, and goods and services tax

- In taxation practices, including the creation of a Business Activity Statement (BAS), an Instalment Activity Statement (IAS), and an individual Income Tax return, information systems are used.

- Describe a tax agent's statutory and professional duties, as well as how these requirements affect practitioner behaviour.

Indeed the course is a little bit tricky and confusing, so if you need ACCT6005 Taxation Law and Practice assignment help online, then do not hesitate to contact our experts. We will serve you the best services at the most reasonable price rate.

What Topics are Covered in This Course?

Our Essay Writing Help provider says that the course covers all important parts of tax. It will give you a clear picture of the tax system and how the government has benefited from the tax income. The course is very vast, so here we have added some important concepts and topics that you come across during the course curriculum. Take a look at what we have jotted here -

- Overview of taxation law

- Payroll system

- Payment summaries and PAYG

- Goods and service tax

- Income tax

- Types of taxes

- Tax and government

- Fringe Benefits Tax

- Types and concepts of income

- Statutory income

- Capital Gains Tax

- exempt income

- Tax deductions

- General deduction

- Tax accounting

- taxation of individuals and software

- Taxation of entities

- Tax ethics

- Tax agents

- Taxation administration and so on.

These are just a few topics that we have covered. If you get an assignment on any of the mentioned topics or apart from this, then we can help you with that via one-to-one online tutoring services. Our ACCT6005 Taxation Law and Practice academic assistance are apt to resolve your doubts and queries.

Sample Assignments Done under the Guidance of Our Team

When it comes to assignment aid, students have always turned to Sample Assignment first. You can rely on our experts. It will assist you in completing the project without exerting any effort on your part. We have provided online assistance to several students, assisting them in completing their assignments on time. So, have a look at a sample of the work they've completed -

Assignment –

Solution –

If you need the ACCT6005 Taxation Law and Practice assignment sample online for reference, then you need to register your email ID on our website, and soon you will get access to download the assignment sample file flawlessly. Moreover, you can also ask our experts to guide you through your assignment.

List of Best Universities of Taxation Course in Australia

There are hundreds of colleges and universities in Australia that offer the best course, yet they are not ranking. It might be difficult to find the appropriate university for you, so to help you out, we have come up with a list of the best universities where you can apply for the taxation course. Take a quick look at what we have jotted here -

- University of Melbourne Law School

- Sydney Law School – University of Sydney

- Monash university

- The University of Adelaide

- The University of Western Australia

- Macquarie University and so on.

What are the Benefits of Taking Assignment Help from Our Company?

You must have been wondering what makes us different? What students always choose us for assignment help? So to answer these queries of yours, we have added some points here. Go through these points, all your doubts and confusions will vanish.

- Learn from the experts on a one-to-one basis. It will help you develop a clear understanding of the topic. We also provide doubt-solving sessions to ensure you are well-versed in the topic.

- Get yourself a free demo class with the expert. It will not only help you get acquainted with the teaching method of the academic expertise but also get an insight into the topic.

- The experts assist with research along with clearing your doubts on any topic. Students often tend to waste a lot of time researching and still do not get anything done. Researching under the guidance of an expert will not only save time, but you will also learn a handful of tips and tricks that will prove fruitful all your life.

- We are available 24x7 for you. We understand that there is no time in your hand to write an assignment by conducting thorough research, which is why our experts are readily available to help you.

- We have a large group of academic experts and hence, can assist with every topic. Be it Taxation Law Assignment Help Australia or any other subject.

Always keep in mind that we are just one click away from you. You can contact us via call or email, and we assure you to give a prompt response. Grab your phone and contact us ASAP to enjoy the perks of ACCT6005 Taxation Law and Practice Assignment Help.

Frequently Asked Questions

The tax-free income of Australia is $18,200.

When it accepts you for either Dad or Partner Pay, it will immediately take a 15% tax deduction.

Yes, our experts provide assignment assistance. They make sure to follow the marking rubric as this is the basics of your assignment and will help you get good marks.

You can pay via bank account transfer, debit or MasterCard, or online paying services like Razorpay and PayU. We accept all payment methods.

Yes, we provide a big discount to our old customers as they have trusted us for a long time.

Clients Speaks

Order Now @ Upto 50% Off

Get

Flat 50% Off

on your Assignment Now!